What is a 1040 Schedule C Form?

Every business has its corresponding profit or loss over the sales of its services or products. Before going to the question of quality, it is important to be aware of the management of the revenue utilized over a set period. The profit or loss from business Form allows the managers of any business to find the loopholes within their income, expenses, or other miscellaneous purchases.

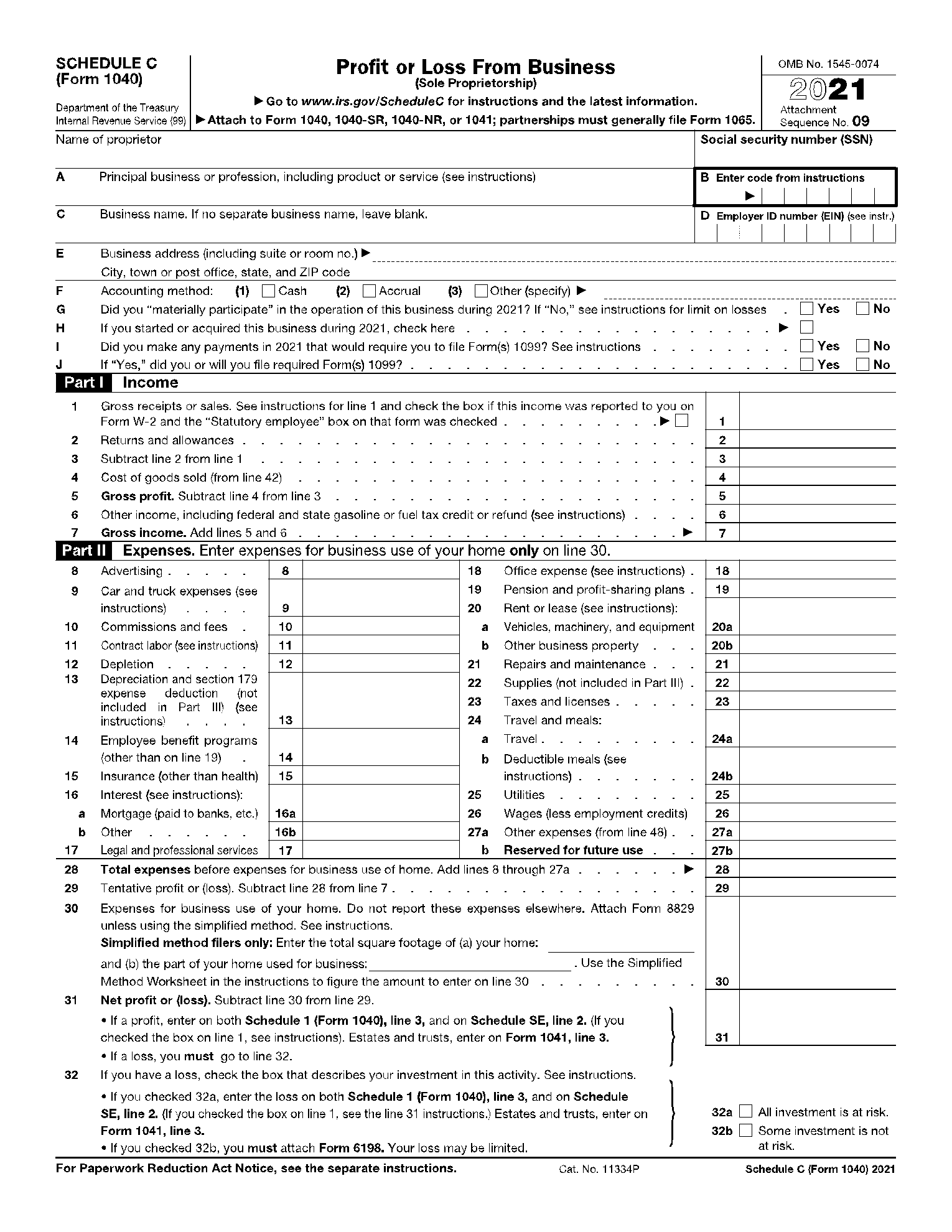

The use of a profit or loss from the business form is quite extensive. With all the necessary information taken across the form, the submitted data is kept as a government record. Known as the 2021 Schedule C Form or the Form 1040, the data provided across the form is also used for other purposes.

Information Required in a 1040 Schedule C Form

The 2021 Schedule C Form takes up a very consistent set of information across the form. All the details provided are kept confidential and are regulated accordingly. The data provided across the form even holds legal jurisdiction, where it is only required under cases where the business is based over a sole proprietorship. If you solely own a business and consider filling out this Form 1040, you need to look into the following details:

- Official Name, SSN, and Employer ID of the sole proprietor.

- The purpose or principle of the business with a discussion of the product or service provided.

- Name of the business and official address.

- Details about the accounting methods, payments, or other forms filled over the span.

- Details of the business's Income, which majorly includes Gross receipts, Returns, Costs, Gross profit, etc.

- The total expenses are made for the business, followed by the expenses made from the business's revenue across the home.

- Net profit or loss calculation, with details about the investment risks.

- Details over the cost of goods that are being sold.

- Information about the vehicle if it covers business operations.

- List down other expenses that are not included in the list provided within the form.

How to Fill Out a 1040 Schedule C Form

The complete procedure of filling out a 2021 Schedule C Form is quite elementary in the fields provided. The form itself constitutes most of the details that should be mentioned within business expenses, leaving behind a very small set of details that may not be included within the form. However, if someone is looking forward to filling out the details within such a form, they need to look over the steps as described below.

Step 1: Add in the name, SSN, and employee ID of the sole proprietor of the business. Provide the principal product or service of the business, its name, and assorted address.

Step 2: Check the box, ensuring the appropriate accounting method is used in the form. Tick the boxes explaining the details about the business acquiring conditions and payments made over the years.

Step 3: List down all the details of the incomes made under the ambits of the business. Provide accurate details about every form of income that the business has covered.

Step 4: The form contains a very comprehensive list of expenses any business can make. Fill out the form with the exact metrics to help calculate the total expenses made.

Step 5: Calculate the net profit or loss according to the expenses provided.

Step 6: Proceed to fill out the form according to the conditions of the business, if it is either in loss or profit.

Step 7: Provide the details about how the goods are sold, including the methods used, inventory details, cost of labor, etc.

Step 8: List the details of the vehicle if it is used for business purposes.

Step 9: Provide any extra details of expenses if any of them is missed within the upper section of the form.

What is a 1040 Schedule C Form Used For?

Form 1040 has a very diverse purpose, considering the information provided across it. As the form discusses everything about the business's expenses, there are few consistent use cases associated with it. The form can be primarily used to calculate the profit or loss of the business. This form is also utilized to verify the conditions of tax payments, which are to be provided by the government.